Family Offices and HNWIs often experience difficulties when dealing with the administration of assets they hold, such as:

-

several types of asset (quoted or non-quoted, private equities, real estate, non-generating income possessions, art works, etc);

-

assets in different forms (indirect, in trust, via investment funds, in nominee through their banks, in common ownership with other family members or third parties), and;

-

in different countries (their country of residence, but also in places where they have former relations, where they were born, or where their banks have sub-custody, etc).

These factors can complicate the Family Office's administration task and prevent full transparency in respect of the valuation of assets, income, and risk. They can also hinders procedure for external parties, such as administrators, transfer agents, and be problematic for efficient reporting to legal or tax authorities. Family Offices therefore need advisors and managers who are able to provide the highest levels of service in consolidating assets and developing appropriate reporting systems.

In order to achieve these objectives, portfolio managers require instant access to client portfolios and associated market information to achieve highest asset performance and consequently enhance client wealth. Automation of monitoring, reporting, regulatory compliance and rebalancing is therefore essential.

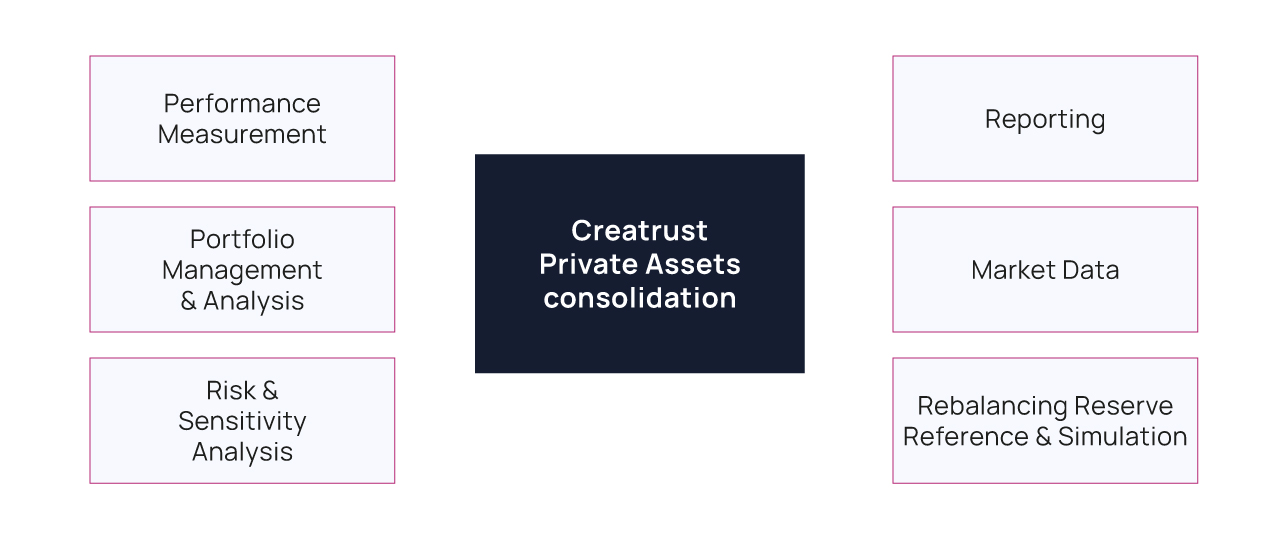

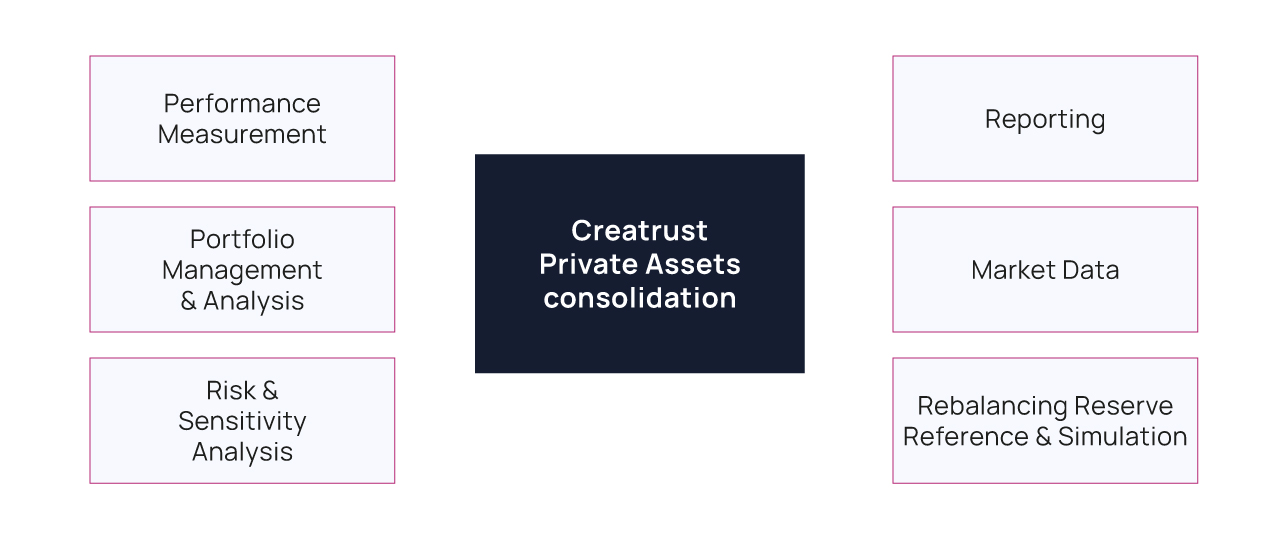

Consolidation of assets to assist with wealth reporting

Such service can help to ensure the family office meets its wealth and asset planning objectives with direction and confidence.

Creatrust is specialised in assisting family offices alongside detailed knowledge of the sector; this includes offering guidance on income reporting, private asset reporting and other administrative services.

Full assessment for evolution and growth of wealth

Creatrust's solution to the problems faced by family offices is to provide full consolidation of assets - wherever they are held, whatever form they are in, and however they are maintained or administered.

At each applicable period, the Family Office will be able to assess the total assets managed, evolution of wealth, global return, costs/fees paid to the various counterparties and related risks linked to the portfolio. The ability to make quick, astute decisions and execute them in a volatile market will become easier and more secure.

The Family Office, or its external managers, can immediately take advantage of our sound reporting and an adapted front office investment management application.

Portfolio Management & Analytics

We offer investment managers accurate, up-to-date portfolio analysis.

Account aggregation allows Family Offices to group their accounts into consolidated views such as by different family members/interests or by manager's relationships, etc.

Investments can be grouped by multiple asset allocation classifications including sector, geography and currency.

Valuations are available, upon request, to detail historical purchases, market value, realised or unrealised gains/losses, and portfolio return.

Cash forecasting is aided by a cash ladder and detailed analysis of cash transactions.

Rebalancing, Reverse portfolio & Simulation

Each portfolio manager can select strategic and tactical asset allocation, geographical mix and sector spread.

The rebalancing process highlights when portfolios diverge from the agreed model or investment strategy by more than the agreed tolerance, and suggests appropriate buying/selling orders to realign the portfolio with the model and bulks these orders across multiple portfolios.

The Extended Reverse Portfolio feature allows users to quickly set-up and execute cross-portfolio queries, using standard portfolio characteristics such as: management type, risk profile, investment objective, role, and combine them with cash and security holding information.

The simulation feature allows the user to prepare various transaction buying/selling scenarios, to simulate the effect on the portfolio and compare to the model or strategy.

Risk & Sensitivity Analysis

Effective risk management is dependent on knowing a portfolio's structure and its breakdown over different categories. Creatrust's solution enables the investment manager to analyse the exposure at different levels, taking into account the underlying exposure of any mutual funds (look through).

Performance Measurement

The fundamental objective of investment management is to generate performance return within the risk boundaries agreed by the Family Office's global investment manager.

Our solution supports full portfolio performance measurement analysis adhering to the latest international standards such as GIPS.

Creatrust provides real-time calculation of performance return, plus unrealised and realised Profit and Loss (P&L) over any period, analysed with benchmark comparisons using both market and composite indices where necessary. Performance is calculated using the true daily Time-Weighted Rate of Return (TWRR) or Money Weighted Return.

Reporting

We can deliver high-impact, flexible client reports quickly and cost-effectively, incorporating full-colour graphic presentations to make communication clear and accurate.

We will propose a set of pre-defined portfolio reports which can be partially tailored to meet the demands of individual members of the Family Office. All reports comply with the Family Office standards. Portfolio reports are based on any user-selected classification for the Family Office's global investment manager.

Market data

The Creatrust solution also includes extensive data for multiple asset classes across global markets: to include asset information for bonds, funds, securities and indices, end of day prices, and exchange rates.