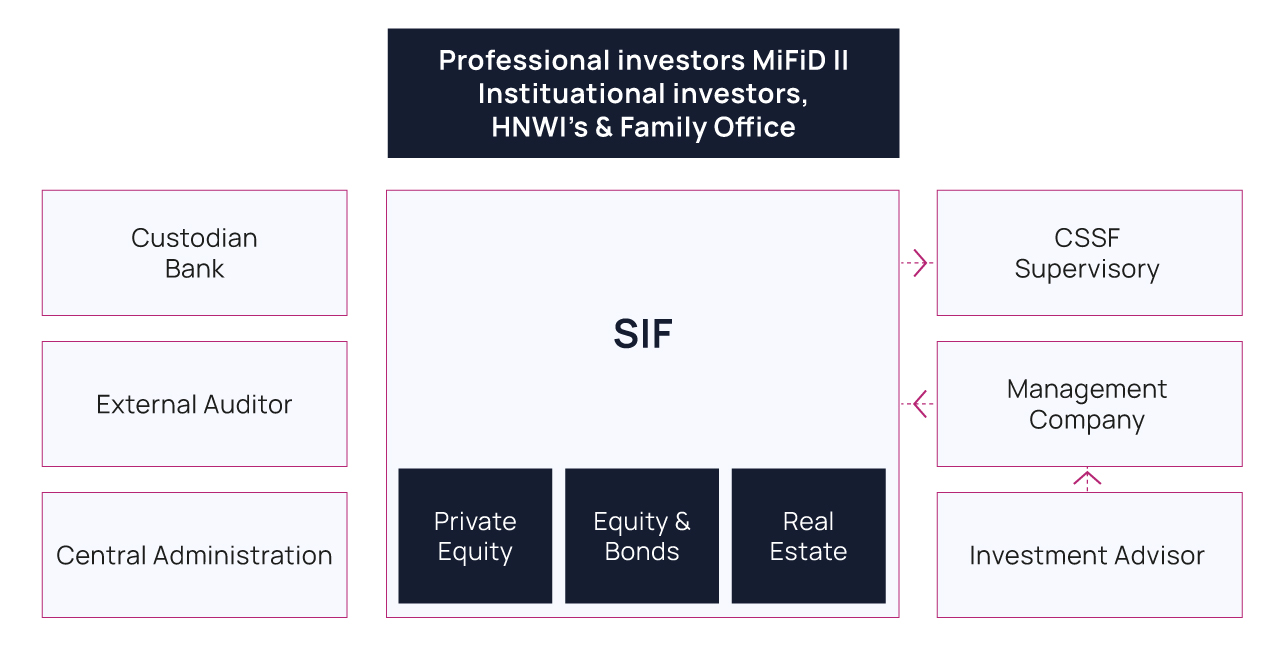

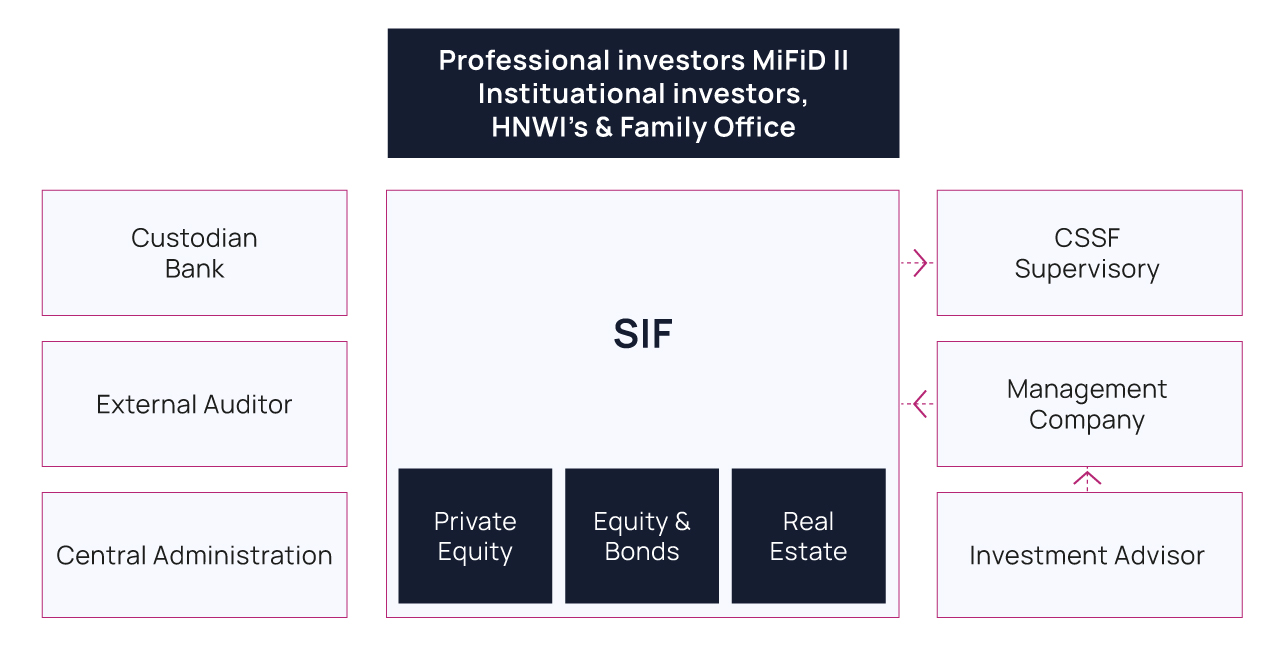

The Specialised Investment Fund (SIF) is a regulated, Luxembourg-branded, investment fund vehicle for well informed, institutional and qualified investors.

A SIF may take the legal form of a common fund (a mutual fund, FCP – fonds Commun de Placement)

or may be incorporated as an investment company (SICAV –Société d'Investissement à Capital Variable or SICAF – Société d'Investissement à Capital Fixe).

A Specialised Investment Fund is specificaly designed to invest in alternative assets like :

-

private equities

-

hedge fund strategies

-

real estate

-

credit strategies (bonds, direct lending, Peer To Peer, high yield, etc)

-

derivatives (futures, options, etc)

-

collectibles (wines, art works, jewelry, old cars, diamonds, etc)

-

Fund of Funds

-

other type of alternative investment with no limitation

except that at any time the exposure on any of the asset of the Specialised Investment Fund cannot exceed 30 percents of the total AUM. (risk spreading rule)

A SICAV/SICAF can be established from the following legal forms:

-

Public Limited Company ( PLC –Société Anonyme)

-

Private Limited Company (LTD – Société à Responsabilité Limitée)

-

Partnership Limited by shares (SCA – Société en Commandite par Actions)

-

Co-operative company organised as a public limited company (Coopsa –Société Co-opérative organisée comme une Société Anonyme).

-

Special Limited Partnership (SLP – Société en Commandite Spéciale)

Each Specialised Investment Fund may be set up as a stand-alone fund or as an umbrella fund with multiple compartments; each with a different investment policy and an unlimited number of share classes, depending on the needs of the investors and fee structure.

The structures may be open-ended or closed-ended.

The FCP has no legal personality and must be managed by a separate management company established in Luxembourg.

Specialised Investment Fund advice with Creatrust

Specialised Investment Funds (SIFs) represent a flexible and financially intelligent choice for international investors looking to benefit from Luxembourg's favourable regulatory regime.

Creatrust provides impartial and specialist skill and knowledge based on trust, clear communication and an understanding of the key issues, including those that are specific to Luxembourg as well as those that apply to investors from other parts of Europe and throughout the world.

Our expertise is entirely in-house and is enhanced by a commitment to continual fiscal, regulatory and technological innovation; to achieve the exact vehicle structure for the customer's needs; ensuring your requirements, and those of the investors, are met fully.

Eligible assets for a Specialised Investment Fund

The principal characteristic of the Specialised Investment Fund (SIF) is the lack of any constraints on the type of assets in which it can invest and a lighter supervisory regime.

Since investments are allowable in any type of assets, the SIF is suitable for establishing anything from a traditional securities or money market fund to the creation of a real-estate fund, hedge fund or private equity fund. The SIF must have active portfolio management.

The SIF's investments can be made in any type of asset, with no exclusion in Luxembourg or abroad:

-

Bonds, shares, financial instruments, other funds, other SIF, fund of funds, structured products, ETF, derivative ( warrants, options, futures)

-

Any hedge fund strategies (CTA, Long/short, Global Macro, Systematic, Event Driven, Commodities, Emerging Market, Protection of Tail Risk, Managed Futures, Technology)

-

Real estate (commercial, private, directly or indirectly)

-

Private equity (shares, loans, funds)

-

Distressed (debt, vulture funds, securitisation)

-

Currencies, precious metals

-

Cleantech, "Green" investments or projects

-

Micro Finance

-

Also art work, cars, jewellery, watches, wine.

Diversification requirements in a SIF

There is a Risk diversification requirement which is defined by CSSF Circular n° 07/309.

Broadly, the Specialised Investment Fund may not invest more than 30% of its total asset in a single underlying asset.

Should the SIF invest in one subsidiary where the risk diversification test is met, the CSSF may accept this based on the fact that a control may be exercised on the subsidiary to ensure safe keeping of the assets.

Eligible Investors in a SIF

Given the lower level of investor protection offered, SIFs are not designed for the general public. They are suitable for sophisticated investors looking for maximum flexibility in order to give scope to their expertise and their specific needs.

By "sophisticated investors" the law means institutional and professional investors, and any other person who can provide written assurance that he or she is a qualified investor and has either a minimum of EUR 125,000 to invest, or an attestation from a bank, investment company or management company to certify that he or she has the necessary knowledge and experience to evaluate an investment in the SIF.

Specialised funds have more lenient publication obligations than funds destined for the general public and benefit from more flexible regulation of their activity. They are, however, obliged to put in place an effective system to monitor, measure and manage portfolio investment risk. They must also be structured so as to limit as far as possible the risk of conflicts of interest between the fund and its investors.

There are also several conditions attached to the delegation of tasks to third parties. Similar to funds designed for the general public, the SIF must respect the principal of risk diversification, but the law does not set any quantitative limits on the fund's investments. SIFs can be created as multiple compartment funds. They can issue an unlimited number of different share classes, which allows each fund and sub-fund to be designed to the needs and preferences of particular target investors. The SIF does not require a promoter. However, like other Luxembourg regulated investment vehicles it is authorised and supervised by the CSSF.

Capital requirement

If the SICAV/SICAF is incorporated as:

-

a public limited company (SA) or a partnership limited by shares (SCA), the SIF must have a minimum capital of EUR 31,000 upon incorporation

-

a private limited company (SàRL), the SIF must have a minimum capital of EUR 12,500 upon incorporation

-

a Coopsa, no minimum capital is required.

A minimum of EUR 1,250,000 net assets must be reached within a period of 12 months following its authorisation by CSSF. Only 5% of the capital needs to be paid up on subscription.

Authorisation and supervision

As a regulated vehicle, the SIF must be approved by the Luxembourg supervisory authority, CSSF.

The application can be made quite quickly in order to receive approval from the CSSF and start its incorporation.

The application file will be analysed by CSSF and the authorisation will be granted subject to:

-

approval of the constitutional documents

-

approval of the choice of depositary bank

-

approval of the directors of the fund or managers of the management company

-

risk management function description

-

approval of the choice of auditor

Taxation of a Specialised Investment Fund

Investment funds created under the SIF Law pay an annual subscription tax (taxe d'abonnement) of 0.01% of their net asset value; payable on the last day of every calendar quarter.

Investments such as certain money markets and pension funds, or SIFs investing in other funds which are already subject to subscription tax, are exempt from subscription tax. The same applies to microfinance investment funds.

Previously, a fixed capital duty had been payable by the investment fund on incorporation, but this was abolished as from 1 January 2009.

Investment funds incorporated as investment companies are subject to a registration duty of EUR 75 at incorporation and in case of modification of the articles of incorporation, as well as transfer of the effective place of management or registered office to Luxembourg. Investment funds constituted as FCPs are not subject to this registration duty.

Service providers

Management company:

A common fund has no legal personality and must therefore be managed by a management company.

The individuals who effectively conduct the business of a management company must be of good repute and be sufficiently experienced in respect of the type of SIF to be managed. The management company must have an initial capital of at least EUR 125,000.

Depositary bank:

Luxembourg SIFs must appoint a credit institution as depositary bank which is responsible for both the safekeeping of assets and the supervision of the fund and its management company (FCP).

Central administration:

The central administration of a Specialised Investment Fund must be in Luxembourg, but certain functions may be outsourced to a third party for the purpose of a more efficient conduct of business. This concerns the accounting, NAV calculation, keeping of the register of shareholders/unit holders, handling of subscriptions and redemptions, communication with investors and preparation of financial statements.

External Auditor:

The fund (SICAV) or its management company (FCP) prepares an annual report which is to be audited by an authorised external auditor with appropriate professional experience. There is no obligation to produce a semi-annual report.

Law of 13 February 2007 relating to specialised investment funds:

CSSF Circular n° 07/283: Entry into force of the law of 13 February 2007 relating to specialised investment funds

CSSF Circular n° 07/309: Risk-spreading in the context of specialised investment funds

CSSF Circular n° 07/310: Financial information to be produced by specialised investment funds

CSSF Circular n° 08/372: Guidelines for depositaries of SIFs adopting alternative investment strategies, where those funds use the service of a prime broker

SIF Legislation: Consolidated version of the SIF Law dated 26 March 2012.

Read also