Incorporate a Holding in Luxembourg

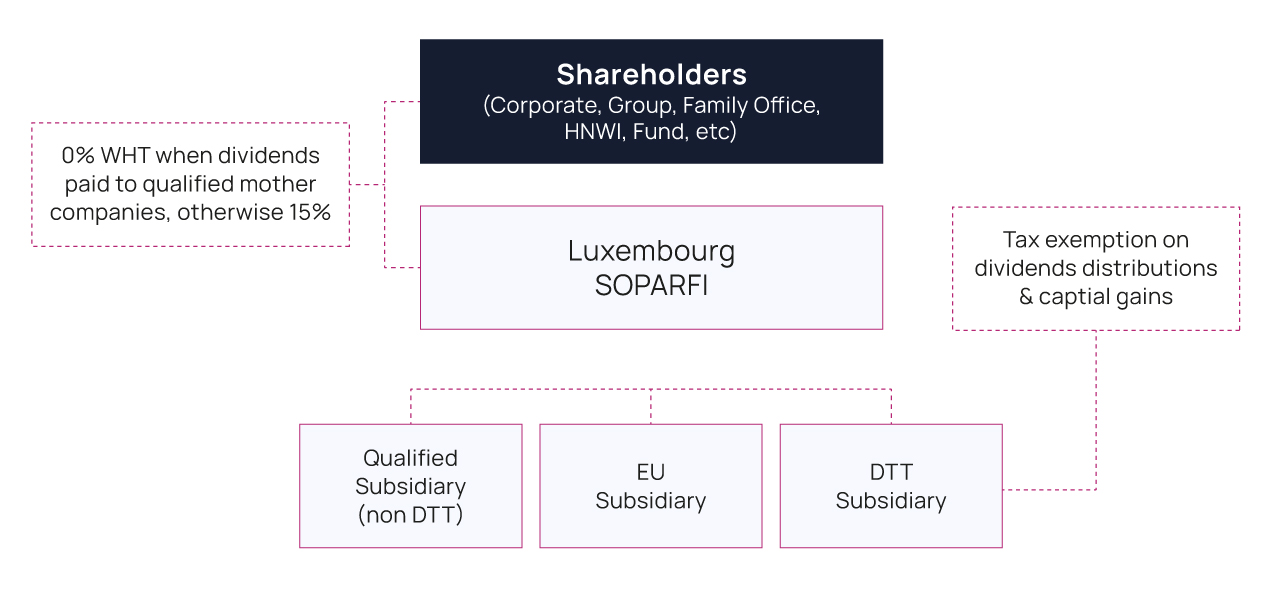

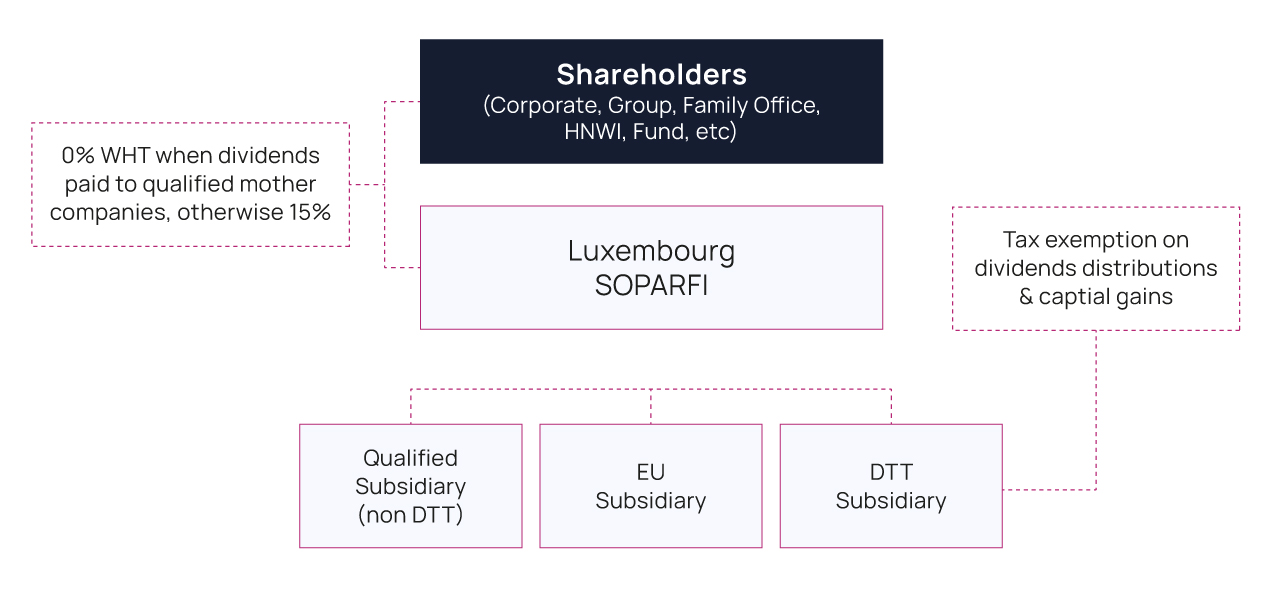

Luxembourg is home to thousands of holding companies called SOPARFIs (Sociétés de Participation Financière) who invest in the economy, in people, in participations around the world in different sectors of the industry, finance, infrastructure, IT, digital economy, asset management, etc

SOPARFIs are the ideal vehicle to :

Depending on the needs of the investor regarding capital, management control and share transferability, the SOPARFI can take one of the following forms:

-

Public limited company (S.A.)

-

Private limited liability company (S.à R.L.)

-

Partnership limited by shares (S.C.A.)

-

Cooperative in the form of a public limited company (CoopSA)

-

European company (SE)

Eligible Assets in a SOPARFI

The Soparfi may invest in any type of assets in Luxembourg or abroad:

-

Material or immaterial assets

-

Securities such as stocks, shares, bonds

-

Real-estate

-

Cash, currencies, commodities

-

Loans, distressed assets

-

Contracts with third parties.

Equity/Liabilities issued by a SOPARFI

The SOPARFI may issue, depending on its legal form, shares of different classes, nominative or bearer shares.

Shareholders/Investors can be any type of person: institutional, investment funds, natural persons (individuals), companies, trusts or foundations, other SOPARFI or holding entities, funds or Special Purpose Vehicles.

The Minimum capital for S.A./S.C.A.is: €31,000 (minimum ¼ paid in) and for S.à.R.L.: €12,500 (fully paid in) or equivalent non-euro currency.

The Investors may set up the company by contribution in cash or in kind. No capital duty applies on incorporation (except a fixed registration duty of €75). An External Auditor’s valuation is mandatory only for SA/SCA but not for a SARL.

The SOPARFI’s shares can be listed in Luxembourg or abroad.

Share premium may be used when issuing shares. Contributions must not necessarily be represented by an increase in share capital or issuing of shares but can simply be brought in by increasing the share premium.

The SOPARFI may issue any type of debt instrument, such as:

-

Convertible Preferred Equity Certificates (CPEC),

-

Preferred Equity Certificates (PEC),

-

Subordinated Notes,

-

Convertible Bonds,

-

Bonds,

-

Warrants,

-

Tracker Certificates, and

-

any other debt instruments

While there is no formal debt/equity ratio, however should the participations are financed by an interest bearing debt a 85:15 ratio is required in practice

Taxation in Luxembourg

In Luxembourg, the normal rate tax for entities is 29.22%. It includes Corporate Income Tax (“CIT”)plus the solidarity surcharge, and the Communal Business Tax (“CBT”).

Moreover, corporate entities are also subject to the Wealth Tax at a rate of 0,5%. This rate is established on the base of the net assets owned by the company.

The income tax for resident and non-resident entities is set as follows for the tax year 2017:

-

15% when the taxable income does not exceed EUR 25,000;

-

39% on the taxable income exceeding EUR 25,000 up till the taxable income has reached the limit of EUR 30,000;

A solidarity surcharge of 7% is also imposed on the CIT amount.

A minimum net worth tax, replacing the minimum income tax, is applicale as from fiscal year 2016.

Collective entities whose sum of the financial assets, transferable securities and bank deposits is more than 90% of the balance sheet and when the total balance sheet exceeds EUR 350,000 are liable to a minimum net worth tax of EUR 4,815 (including the solidarity surcharges).

Entities having a total balance sheet below EUR 350,000 will be liable to pay only a minimum net worth tax of EUR 535 (including the solidarity surcharge) annually.

The 90% rule determining the amount of the CIT is based on the total of four account items:

Other collective entities are subject to a progressive minimum income tax depending on the total assets on their balance sheet, as follows:

|

Total assets (EUR)

|

Minimum CIT (EUR)

Incl. Solidarity surcharge

|

|

Up to 350.000

|

535

|

|

350.001 to 2.000.000

|

1.605

|

|

2.000.001 to 10.000.000

|

5.350

|

|

10.000.001 to 15.000.000

|

10.700

|

|

15.000.001 to 20.000.000

|

16.050

|

|

20.000.001 to 30.000.000

|

21.400

|

|

30.000.001 and above

|

32.100

|

'Total assets' means the total of the last closing balance sheet of the tax year. For those entities not subject to community accounting requirements, the balance sheet total comprises the total assets on the balance sheet.

More information in our Creavision on Minimum Income Tax in Luxembourg, contact us

SOPARFI advice with Creatrust

It is no accident that Luxembourg is one of the world's five wealthiest countries (based on per capita GDP). This is because although the Grand Duchy is one of the smallest countries in the world, it was one of the first six members of the EU and has a highly developed economy that draws on innovative banking, financial and legal sectors.

As a leader in its field, Creatrust is ideally placed to help you take full advantage of Luxembourg legislation and the various EU Directives that make Luxembourg's SOPARFI (Sociétés de Participation Financière) holding companies such an attractive option to the savvy investor.

Read also: