The Trusted Partner for Loan Syndication

SLaaS, is a service of syndication of loans using the creation of a Luxembourg Special Purpose Vehicles (SPVs) for securitization and loan syndication.

SLaas bridges the gap between investors and borrowers by providing a seamless platform for syndicating loans.

By leveraging years of expertise, the promoter will unlock the full potential of the investment with reduced risk, costs, timing and enhanced returns for investors.

How does it work?

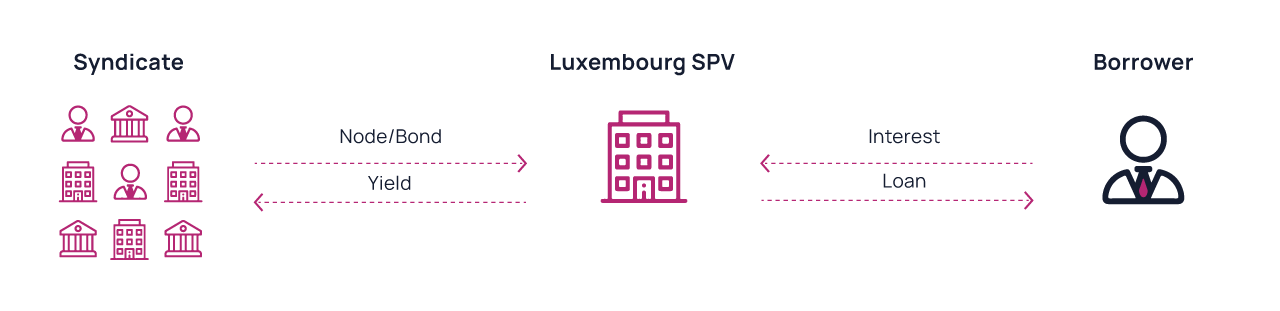

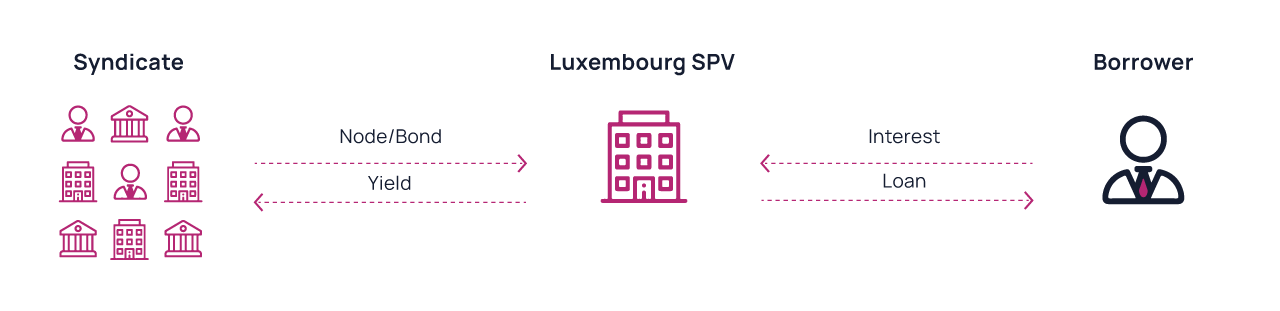

A Securitization SPV is put in place for the transaction.

The securitisation is the process of pooling various types of debt—including loans —and selling them as consolidated financial instruments to investors.

This allows investors to diversify their portfolios while providing borrowers with access to a broader range of financing options.

For loan syndication, the SPV is created and issues notes to investors, who pool their money to invest into the Loan.

What type of Loan is eligible?

SLaas is used by hundreds of promoters to syndicate numerous types of Loans and Receivables among which :

- Straight loan

- Facility agreements

- Notes, bonds, certificates, etc

- Receivables

- Current accounts

- Shareholder loans

- Mortgage

- etc

Services

- SPV Creation and Management

- Special Purpose Vehicles (SPVs) are established and managed, tailored to specific investment needs. The SPVs are structured to ensure maximum efficiency and compliance with regulatory standards.

- Loan Syndication

- The platform facilitates the syndication of loans by connecting multiple investors to a single borrowing entity. This spreads the risk and makes larger funding projects feasible.

- Risk Assessment and Management

- Thorough risk assessments are conducted to ensure the viability of each loan. A team of experts uses advanced analytics to monitor and manage risks, providing peace of mind to investors.

- Comprehensive Reporting

- Stay informed with detailed reports on the performance of investments on the platform. Regular updates and insights are provided, ensuring transparency and informed decision-making.

- Investor Relations and Support

- The dedicated support team is always available to assist with any queries. Building strong relationships with investors is prioritized through consistent communication and support.

Advantages of Loan Syndication Services

- Diversification of Investment Portfolio

- By investing in syndicated loans through SPVs, investors can diversify their investment portfolio, reducing exposure to any single borrower or sector.

- Enhanced Liquidity

- Securitization provides an opportunity to access a more liquid market, allowing for easier buying and selling of loan interests.

- Reduced Risk

- Risk is spread across multiple investors, minimizing the impact of any single default. A robust risk management framework further mitigates potential losses.

- Access to Larger Deals

- Syndication enables participation in larger loan deals that would be unattainable for individual investors, opening up new avenues for investment.

- Expert Management and servicing

- Benefit from the expertise of seasoned professionals who manage the entire process, from due diligence to ongoing administration, ensuring investments are in safe hands.

- Regulatory Compliance

- The SPVs are structured to comply with all relevant regulations, providing a secure and legally sound investment vehicle.